The Bank Nifty index has rallied over 17% in 2022 so far.

The Bank Nifty index hit a new all-time high of 41,949 yesterday. The index has rallied over 17% in 2022 so far and is likely to head higher.

But the main question is who will lead the rally?

Among the constituents of Bank Nifty, in 2022, Bank of Baroda and Federal Bank lead the charts in terms of performance with gains of 95% and 66%, respectively.

If they continue to rally another 50%, will they be able to lead Bank Nifty?

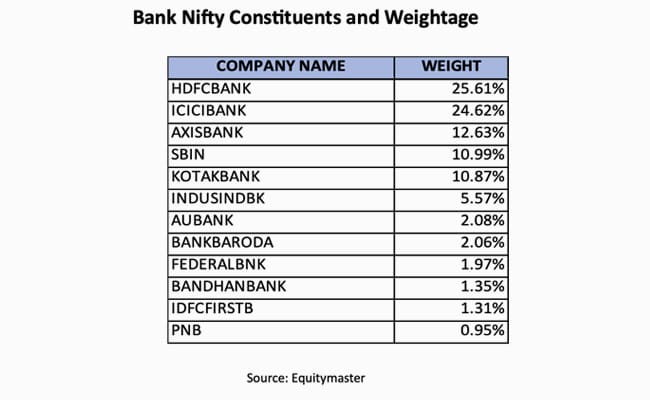

First, let’s look at the constituents and their weights in Bank Nifty.

Bank of Baroda and Federal Bank weigh merely 2% each in the index

With heavyweights like HDFC Bank, ICICI Bank, Axis Bank, State Bank of India (SBI), and Kotak Bank leading the table, their performance matters if the index is to go higher from here on.

The PSU Bank index is coming out of the woods with stupendous back-to-back 44% gains in both 2021 and 2022.

Bank Nifty is led by Private Banks with a weight of 86% while the PSU Banks weigh 14%. The needle will change with the performance of the private banks over PSUs.

The top 5 stocks contribute over 80% to the index and their performance matters a lot.

With a 25% weightage, HDFC Bank has gained 2% for the year. The rally from 35,000 to 42,000 was led by the performance of ICICI Bank, Axis Bank, and SBI.

To play the devil’s advocate here, just imagine if HDFC Bank doesn’t perform and if ICICI Bank, Axis Bank, and SBI were to witness profit booking. The selling may be brutal.

Can HDFC Bank lead Bank Nifty?

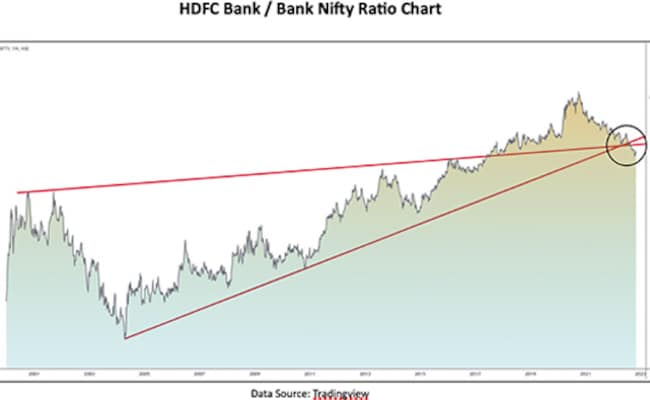

I analysed the ratio chart of HDFC Bank / Bank Nifty to identify the trend of relative outperformance or underperformance.

The ratio chart above highlights an end to the outperformance of HDFC Bank against the Bank Nifty.

It has been 18 years and HDFC Bank is outperforming the Bank Nifty and taking the index to new highs.

But something all beginnings have an end, and it seems to be an end to this trend.

On the ratio chart, the slope is trending southwards and has broken the 18 years rising trendline.

The break of the rising trendline is a sign of reversal from bullish to bearish and the bearish chart means an end to the outperformance of HDFC Bank against Bank Nifty.

This may now act as a sign of the end of the ongoing bullish trend.

If HDFC Bank heads northwards with a faster rally to catch up with ICICI Bank, Axis Bank, and SBI, the failure of the breakdown on the ratio chart can be confirmed. Until then, it’s a sign of caution for Bank Nifty traders.

Banking stocks like ICICI Bank, Axis Bank, and SBI will have to contribute for the Bank Nifty to continue its bullish trend.

Interestingly, the higher high – higher low structure on the long-term chart of the Bank Nifty indicates the bulls are still roaring on D-street.

(Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.)

Featured Video Of The Day

Rupee Falls To 82.90 Against Rising Dollar On Risk-Off Bets; RBI Eyed