A return of foreign investors is bolstering the market, where the benchmark S&P BSE Sensex Index rose to an all-time high on Friday as risk assets rejoiced over a softer US inflation print. An unprecedented retail investing boom, strong domestic demand that’s enabled one of the world’s fastest growth rates and political stability are also tailwinds that have helped India decouple from other emerging markets.

“Amidst the noise of markets around the world today, India is sending the right signals,” said Vikas Pershad, a fund manager for Asian equities at M&G Investments (Singapore) Pte. “There remains much to like about the opportunity set in India, whether judged in absolute or relative terms. The probability that we see of continued outperformance is high.”

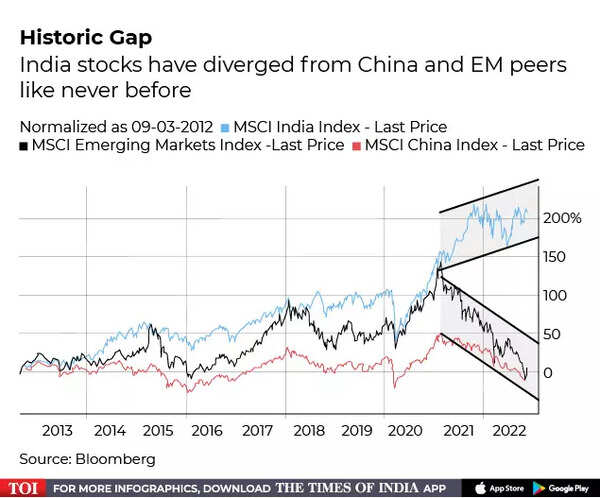

MSCI India gauge set to beat its global peer by the most since 2014

Up 6.1% this year, the Sensex is on course for a seventh straight annual advance. Its gain is the biggest among benchmarks in countries that have stock markets valued at at least $1 trillion, and compares with a loss of 23% in the MSCI Emerging Markets Index. The MSCI All-Country World Index is down 18% in 2022.

While local retail money helped cushion the Indian market earlier in the year amid a record foreign exodus sparked by the Federal Reserve’s aggressive rate hikes, stocks have gone from strength to strength since this year’s lows in June as overseas buyers slowly returned. Robust earnings for the latest quarter have also boosted investors’ faith in the economic recovery.

India recently overtook the UK to become the world’s fifth largest economy. Gross domestic product is forecast to expand 7.0% in fiscal year 2023, according to a recent Bloomberg News survey.

China diversifier

India has also been a beneficiary of this year’s relentless plunge in China that’s spooked global funds. While they sold Chinese equities in October, Indian shares witnessed an inflow. Overall, foreigners have bought a net $2.5 billion of India stocks so far this quarter after scooping up $6 billion in the previous three months.

“From an asset allocation perspective, we see India equities as a diversifier for China reopening risks,” said Ray Sharma-Ong, investment director of multi-asset solutions at abrdn plc. “We see India equities staying fairly resilient in the current environment.

Trends in flows — both foreign and local retail money — and investor response to further policy tightening by the Reserve Bank of India could be key to the outlook for stocks.

Meanwhile, China’s beaten-down market is staging a sharp rebound in November as signs emerge that authorities are shifting away from the strict Covid Zero policy. The rally extended on Monday, with property names surging as the nation plans its most sweeping rescue package for the sector.

Given that Covid controls and the property crisis have been the biggest sore points for investors, the steps by authorities could spur a rush among funds to pile into Chinese assets, impacting demand for Indian ones.

“Strengthening of oil price also poses a key risk,” said Sat Duhra, a Singapore-based fund manager at Janus Henderson Investors. India imports nearly three-fourth of its oil, making it one of the most vulnerable in Asia to higher prices. “In the face of rising external risks, it is difficult to see India continuing this level of valuation premium.”

Structural growth

Still, many long-term market watchers say India’s market performance will be aided by underlying fundamentals such as favorable demographics that are at the heart of its domestic-driven economy.

Government incentives are also attracting foreign companies, including iphone manufacturers, to set up plants in India, boosting local output and luring foreign investment.

“Given all the problems we see in markets globally, India is a safe haven,” said Tushar Pradhan, chief investment officer at HSBC Asset Management India. India’s per capita income is set to rise to a higher trajectory, and “When you hit that sort of range, which happened to China 20 years ago, the next 10-20 years is a period of significant income growth.”

Morgan Stanley expects India’s GDP to more than double to over $7.5 trillion by 2031 and its equity market capitalization to grow by over 11% annually to $10 trillion, according to a report last month.

Local investors plowed about $1.1 billion into stock funds in October, marking a 20th straight month of net inflows.

“In all the years that I have been watching the Indian equity market, I have never seen such strong domestic confidence in the economy, in markets in such challenging global conditions,” said Gary Dugan, chief executive officer of the Global CIO Office. “The market’s improved performance is built on structural change and government delivery of its broad promises. We expect the good news to continue to flow.”