The government extended 15 per cent corporate tax benefits to new cooperatives.

New Delhi:

The government on Wednesday simplified various tax benefits on MSMEs, cooperatives, startups and boards, authorities and commissions.

According to the Union Budget tabled on Wednesday, the government had enhanced limits for micro-enterprises and professionals while availing benefits of presumptive taxation. There is a deduction on payments made to MSMEs to be allowed only when payment is actually made.

While for cooperatives, the government extended 15 per cent corporate tax benefits to new cooperatives which would start manufacturing from March 2024.

The government had fixed higher limit of Rs 2 lakh per member for deposits and loans in cash by Primary Agricultural Credit Society (PACS) and Primary Cooperative Agriculture and Rural Development Banks (PCARDBs) and a higher limit of Rs 3 crore for TDS on cash withdrawal for cooperatives.

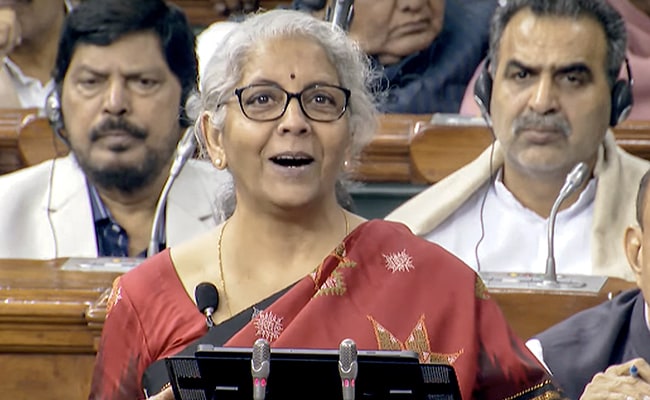

Union Finance Minister Nirmala Sitharaman announced the government proposes to extend the date of incorporation for income tax benefits to startups from March 31, 2023, to March 31, 2024.

According to the Budget, the government also said it would provide the benefit of carry-forward of losses on change of shareholding of startups from seven years of incorporation to 10 years.

The income of authorities, boards and commissions set up by the statutes of the Union or state to be exempted from income tax in certain sectors.

The government had extended of period of tax benefits to funds relocating to IFSC, GIFT city till March 31, 2025.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Featured Video Of The Day

Shah Rukh Khan’s “Alternate Business” Plan And Other Big Quotes