This growth has been driven by the conglomerate’s strong performance, which has delivered impressive returns, with some stocks being multibaggers with gains as high as 218%, according to an ET report.

Investors’ faith in Tata stocks was further demonstrated by the overwhelming response to the Tata Technologies IPO. The IPO, worth Rs 3,042 crore, received bids worth over Rs 1.5 lakh crore and listed at a remarkable premium of 140%.Among the notable performers – multibaggers – in the Tata basket, excluding Tata Tech, are Benares Hotels with a 218% return, Artson Engineering with a 144% return, and Trent with a 119% return.

Tata Investment Corporation, one of the Tata Group’s holding companies, has also seen significant growth, nearly doubling in value with a 99% return in 2023. Tata Motors, the maker of JLR, has emerged as one of the top wealth creators within the Tata family, with the stock rallying approximately 87% in 2023.

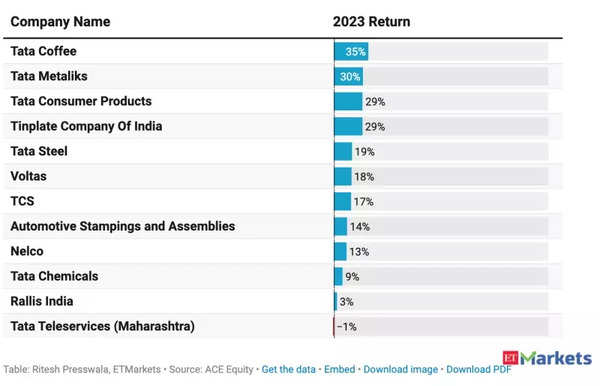

How Tata stocks fared in 2023

How Tata stocks fared in 2023 (Data till December 23, 2023)

In addition to Benaras Hotels, the conglomerate also has Oriental Hotels, whose stock has surged by 67% this year. Indian Hotels, recognized as India’s largest hospitality company by market capitalization, has gained 38% as investors anticipate a cyclical uptick in the sector.

Other major Tata stocks have also seen positive growth, with Tata Power up 57%, Tata Elxsi up 41%, Titan up 39%, Tata Consumer up 29%, Tata Steel up 18.5%, and TCS up 17%.

However, Tata Teleservices (Maharashtra) is the only stock in the group that has delivered a negative return (-1%) in 2023. Despite this, the total market value of 27 Tata stocks (excluding Tata Tech) has risen by Rs 612,619 crore to reach Rs 27,16,694 crore, according to data from ACE Equity quoted by ET.

Experts suggest that investors should consider the Tata Group as a strong performer in the coming decade. In fact, as a group it is expected to outperform all others ove the span of the next decade.

Late Rakesh Jhunjhunwala, a prominent investor, was a firm believer in the Tatas. Even after his passing, Titan and Tata Motors remain the biggest holdings in the Jhunjhunwala family’s portfolio.

Jhunjhunwala had expressed his bullishness on Tatas, stating that he saw potential in the leadership of N Chandrasekaran and believed in the conglomerate’s vision.

While Tata Motors has the highest number of buy calls from analysts, with 28 positive views, Titan also enjoys positive sentiment, with 27 out of 30 analysts covering the stock having a favorable outlook, according to Trendlyne data. Analysts’ bullish stance on TCS has decreased, with only 18 out of 40 recommending buy calls.

Read From ET | Tata stocks journey in 2023

While management pedigree plays a crucial role, it’s not the sole factor influencing stock returns. Not every Tata enterprise guarantees success, so investors shouldn’t overlook factors like business growth potential and valuation.