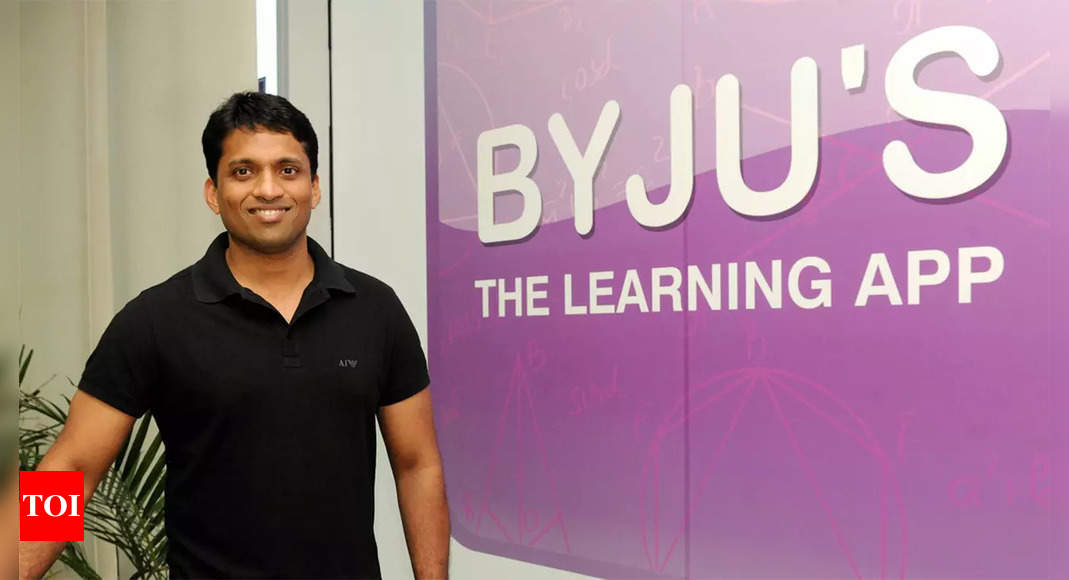

MUMBAI: Ahead of a meeting on Friday called by a group of Byju’s major investors to seek removal of Byju Raveendran from the position of CEO and reconstitution of the startup’s board, Raveendran, in a letter to shareholders, said the company will appoint two non-executive directors to the board to increase shareholder representation.

This will be done with shareholders’ consent after the FY23 audit, which is expected to be closed by the end of this quarter.Byju’s also claimed that its $200-million rights issue has been fully subscribed, adding that it will appoint a third-party agency to monitor the usage of funds raised through the issue.

“This agency will report to all shareholders on a quarterly basis within 45 days from the end of the quarter, along with commentary from the board… a few vested interests are misrepresenting our relationship (between the company and shareholders) as adversarial. There is nothing to be gained from conflict, especially with those who share our commitment and conviction towards our common cause,” Raveendran said in the letter, which was reviewed by TOI.

Sources said that investors including General Atlantic, Prosus and Peak XV Partners are yet to participate in the issue. Cash-starved Byju’s is raising funds through the issue at a valuation of $225-230 million – a 99% drop from its peak valuation of $22 billion. Raveendran, sources said, is investing some $45 million in the rights issue to preserve his shareholding.

This will be done with shareholders’ consent after the FY23 audit, which is expected to be closed by the end of this quarter.Byju’s also claimed that its $200-million rights issue has been fully subscribed, adding that it will appoint a third-party agency to monitor the usage of funds raised through the issue.

“This agency will report to all shareholders on a quarterly basis within 45 days from the end of the quarter, along with commentary from the board… a few vested interests are misrepresenting our relationship (between the company and shareholders) as adversarial. There is nothing to be gained from conflict, especially with those who share our commitment and conviction towards our common cause,” Raveendran said in the letter, which was reviewed by TOI.

Sources said that investors including General Atlantic, Prosus and Peak XV Partners are yet to participate in the issue. Cash-starved Byju’s is raising funds through the issue at a valuation of $225-230 million – a 99% drop from its peak valuation of $22 billion. Raveendran, sources said, is investing some $45 million in the rights issue to preserve his shareholding.