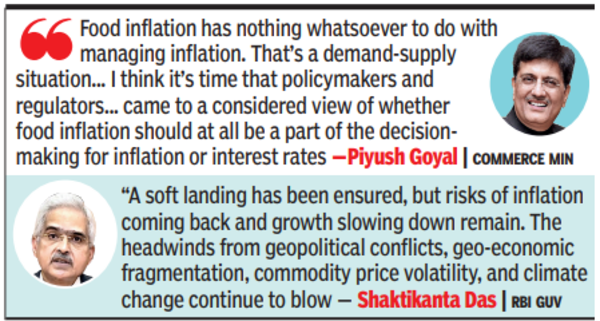

MUMBAI: Commerce minister Piyush Goyal called upon RBI to cut rates, arguing that targeting food price inflation through interest rates was an “absolutely flawed theory”. His statement came days after RBI governor Shaktikanta Das warned of upside risks to inflation from factors like food prices and said that a rate cut should not be taken for granted.

While Das did not react to Goyal’s comment in his speech — which followed a conversation with the minister — he did refer to inflation risks re-emerging. “A soft landing has been ensured, but risks of inflation coming back and growth slowing down remain. The headwinds from geopolitical conflicts, geo-economic fragmentation, commodity price volatility, and climate change continue to blow,” Das said. The minister and RBI governor spoke at a CNBC-TV18 event in Mumbai on Thursday.

“Today, India’s economic growth remains resilient; inflation is expected to moderate despite periodic humps, and the external sector is robust. Without being complacent, let me end by saying that the Indian economy has sailed well through the prolonged period of turbulence and exhibits resilience in the face of constantly emerging new challenges,” Das said. In earlier months, he had highlighted the significance of food prices on inflation expectations among the public.

In his speech, Das noted how RBI and govt have worked together to bring down prices too. While historically, other govt departments have been making representations for easier interest rates, this time is different because the call for a rate cut has been backed by the chief economic advisor asking RBI to look through food inflation. Also, unlike in the past, RBI has been highlighting how it has been working in tandem with govt to control prices.

“I think it’s an absolutely flawed theory that food inflation should be considered while deciding on the interest rate structure. It (food inflation) has nothing whatsoever to do with managing inflation. That’s a demand-supply situation,” Goyal said. He supported his argument by quoting chief economic adviser V Anantha Nageswaran on the topic. “That’s not something that is being hoarded or stocked in large numbers. I think it’s time that policymakers and regulators seriously sat down, discussed with all stakeholders, with economists, even beyond their own, and came to a considered view of whether food inflation should at all be a part of the decision-making for inflation or interest rates,” he added.

At the same event, former RBI governor C Rangarajan said there was a need for a deeper discussion on the interplay between savings, investment and demand. He said that, on the one hand, investment has increased and it needs to be financed by increased savings. But on the other, if consumption/demand is not increasing, it raises a fundamental issue about at what point in the economy’s development the demand factor begins to dominate over savings and investment factors.