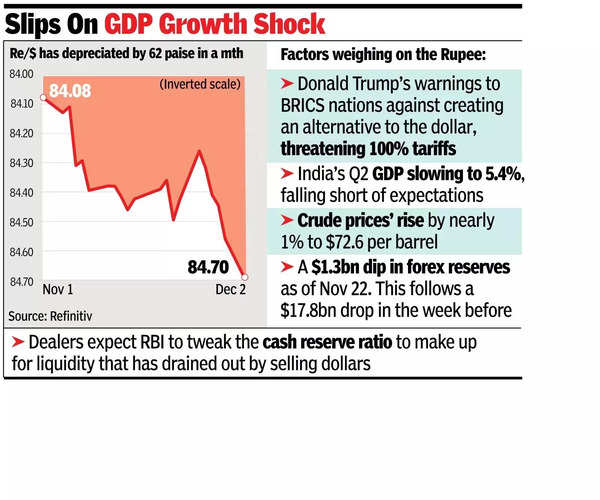

MUMBAI: The rupee fell to a record low of 84.73 against the dollar on Monday, weakening 0.2% for its worst single-day decline since June 4. It touched an intraday low of 84.73 before closing at 84.70 – 14 paise weaker than Friday’s close. This was driven by strong dollar demand in the non-deliverable forward (NDF) markets after weaker-than-expected Q2 growth numbers. RBI intervention, however, has helped limit further losses.

Recently, global factors have compounded the rupee’s woes. The dollar’s strong performance also follows US President-elect Donald Trump’s recent warnings to BRICS nations against creating an alternative to the dollar, and threatening 100% tariffs. This geopolitical tension – coupled with potential Chinese retaliation by devaluing the yuan – has intensified market uncertainty. Analysts predict continued FII outflows amid these challenges.

“It is no longer just macroeconomic factors that are determining the value of the rupee… it is more of geopolitics and the new US administration’s stance on trade. Trump’s warning to BRICS to impose 100% tariff if an alternative arrangement to the dollar if pursued may have an impact on the rupee,” Ashhish Vaidya, head of treasury at DBS Bank, said.

Traders foresee the rupee trading between 84.50 and 84.95 in the near term, with crude oil recovery posing additional risks. However, positive domestic market trends may provide some support. “It is difficult to forecast a level for the rupee. It is not a long way from 85. The question is how far can it go? The double whammy for India would be a stronger dollar and a reduction in govt spending in the US, which could create pressure on most other currencies. Once the new administration in the US is in place and announces some of its policies, it will give the market some sense of direction,” Vaidya added.