The Nifty has been going through what is called a ‘time correction’.(File)

As I write this, the benchmark indices of the Indian stock market, Nifty and Sensex, are close to their all-time highs.

At a time when global market indices are down in the dumps, the Indian market has been a standout performer. Indian stocks have outperformed their global counterparts handsomely in 2022.

The previous all-time closing high on the Nifty was 18,477 back in October 2021. After more than a year, the Nifty is poised to scale new highs.

In fact, the talk on Dalal Street has already shifted to Nifty 20,000.

So what should you make of it, dear reader? Is it time to be bullish or cautious? Should you buy stocks now or consider booking profits?

And what happens after the Nifty crosses 20,000? Will the market keep on scaling new highs or will we see a correction?

Let’s try and answer all these questions and more…

The Market Sentiment Now

To put it simply, the sentiment on Dalal Street right now is bullish but it’s tempered with a bit of caution.

The caution is not due to any specific concern regarding economic growth or the fundamentals of corporate India. Rather it’s due to the uncertainty surrounding the global economy.

You see, there is a legitimate fear of a global recession in financial markets. In fact, it’s safe to say that it’s the most talked about topic in the financial world. Economists are of the opinion that a recession could occur in 2023. This is more likely if the US Fed’s interest rate hikes stifle demand too much from individuals and businesses. Now unlikely that the Indian economy will face a recession. India is growing fast and long-term investing is likely to produce excellent results.

However, investors are well aware that India won’t be immune to a global recession. And that concern has tempered the bullish sentiment to an extent.

But just to be clear, there is no other worry in the Indian market right now. Mutual fund investments continue to drive the market higher. Even the FIIs have started buying Indian stocks once again.

So there’s no doubt the market sentiment is positive right now.

Will the Nifty go to 20,000?

In the current market scenario, the answer would be yes, most probably.

The index is just about 10% away from this mark. It will be a historic milestone for the Indian stock market when it happens.

But the worries about a global recession would prevent a sharp run up in the index. So we shouldn’t expect the Nifty to get to 20,000 within the next few days or weeks.

But beyond the next few weeks, if the sentiment remains positive, we should get there.

What to do at Nifty 20,000?

Would it be a good time to sell or buy?

Well, that would depend on how we get there. If there is a sharp move up in the short term, then the market would be overvalued. And we may see a correction.

In that case, it makes sense to book profits and take some money off the table.

But the situation will be very different if the index remains range bound for a long time.

You see, the Nifty has been going through what is called a ‘time correction’. This is when the price doesn’t fall but the market doesn’t move up either. In other words, the market gets stuck.

This is also a form of correction for two reasons.

First, your investments lose value to inflation.

Second, the companies’ earnings might grow even if the stock price is flat. This results in the stock getting cheaper in terms of valuations, i.e., its PE ratio and PB ratio falls.

In a time correction you should be considering a buy on high-quality stocks. This is because earnings growth would have reduced the valuations. Also such stocks don’t stay cheap for long. And when they finally move, they can turn into multibagger stocks.

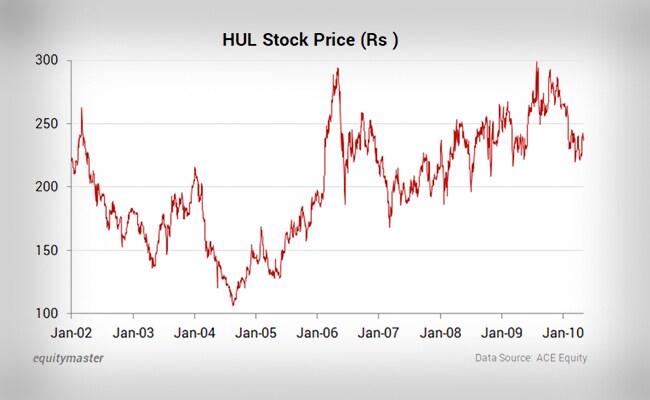

A good example is HUL. Between 2002 to 2010, HUL’s stock price went nowhere.

The stock was basically in an 8 year coma. The returns could barely even make up for the inflation.

However, over the 2010 to 2020 period, HUL delivered a whopping return of 30% CAGR!

So the takeaway is this…

If the Nifty remains rangebound, look for Indian companies with the strongest fundamentals. If these stocks are trading at reasonable valuations, they go ahead and buy them. It’s only a matter of time before they take off.

Life After 20,000

Now, let’s assume the Nifty gets to 20,000. What then? Will the market enter a new bull market or will we see a correction?

This is the million dollar question.

At the moment, no one on Dalal street is willing to stick their neck out and predict the next bull market…and for good reason. The uncertainties in the global economy are too great.

In 2022, the Indian stock market did well in spite of a bleak global environment. It would be foolish to assume this scenario will continue indefinitely.

For a new bull market beyond Nifty 20,000, the rest of the world, especially the US, will have to boom as well. Until then, chasing momentum stocks will be a bad idea.

Just look at how much the former market darlings – Zomato, Paytm, Nykaa, CarTrade, Policybazaar – have fallen. These hot, must have IPOs of 2021 have destroyed over Rs 3.5 trillion in wealth.

So that brings me to the big question: Will we see a short-term peak at Nifty 20,000?

To answer that, we need to dig into history.

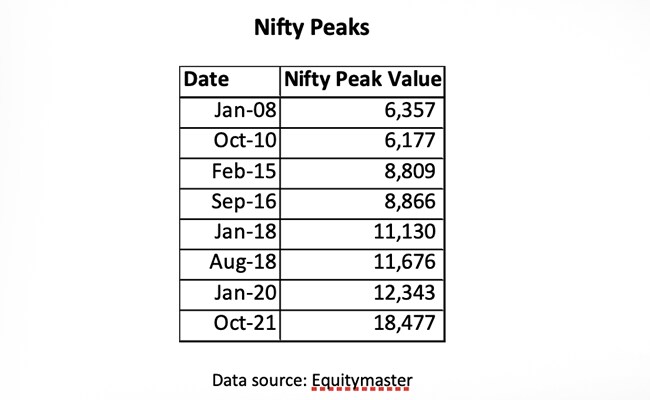

Market peaks haven’t exactly lined up with round numbers on the Nifty. Here’s a table of the Nifty peaks going back to January 2008.

It’s clear from the table that investors should not pay much importance to the 20,000 number. If there is a correction, it could happen before or after.

The corrections that followed these peaks have varied. The 50% decline seen in 2008 is unlikely this time around but we cannot rule out a smaller correction. The recent one which ended in June 2022, was about 17%.

In fact, if we go back further, there have been 10 instances over the last 30 years when the index (Sensex or Nifty) has not entered a bear market i.e. a fall of minimum 20% from the top.

It has only threatened to do so by falling anywhere between 10% and 20%. But it never fell below the 20% mark. It instead recovered and went past the previous highs.

Thus, considering all this we can arrive at a tentative conclusion.

If the Nifty doesn’t enter a bear market i.e. a 20% correction from its all-time high, the chances are good that the Nifty won’t stop at 20,000 when it gets there. It will likely enter a new bull market.

That’s the good news. But in the stock market there are no guarantees. If the world enters a recession, India won’t be spared. We could have a bear market too.

In that case, the bullish scenario of Nifty 20,000 will take a back seat. We may have to wait for some time, perhaps even a few years, for a new all-time high.

How Should You Invest in these Scenarios?

Here’s a good thumb rule to follow when investing in stocks…

Don’t change a winning strategy based on what the market is doing. Stick to a winning strategy, even if it underperforms in the short term.

If the Nifty were to rise to 20,000 in the short term, the market is likely to become euphoric. The sooner it achieves this milestone, the greater will be the euphoria.

It’s important to not get dragged into this sentiment. Here’s a quote from a recent editorial to drive home the point…

In a euphoric market, investors start to behave like Cinderella at the ball. They forget the most basic rule of the stock market: Every bull market ends with either a price correction (like the covid crash) or a time correction (like the last 13 months).

They forget to sell when stocks become overvalued.

So this is what we would like you to take away from this editorial: Don’t become Cinderella at the ball.

If the stock market soars to a new life high next week or later, don’t start buying stocks in haste.

Instead, make a list of the overvalued stocks in your portfolio, and start booking profits. In other words, move slowly towards the exit door.

On the other hand, if the market remains range bound, don’t be disappointed. Use the opportunity to find and buy great stocks for the long term.

As discussed above in the HUL example, these stocks will take off at the first sign of a change in sentiment. Astute investors would have taken positions long before the up move.

Happy investing!

(Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.)

This article is syndicated from Equitymaster.com

Featured Video Of The Day

Sensex Rallies Over 900 Points, Tracking US Stocks Best Performance Since 2020