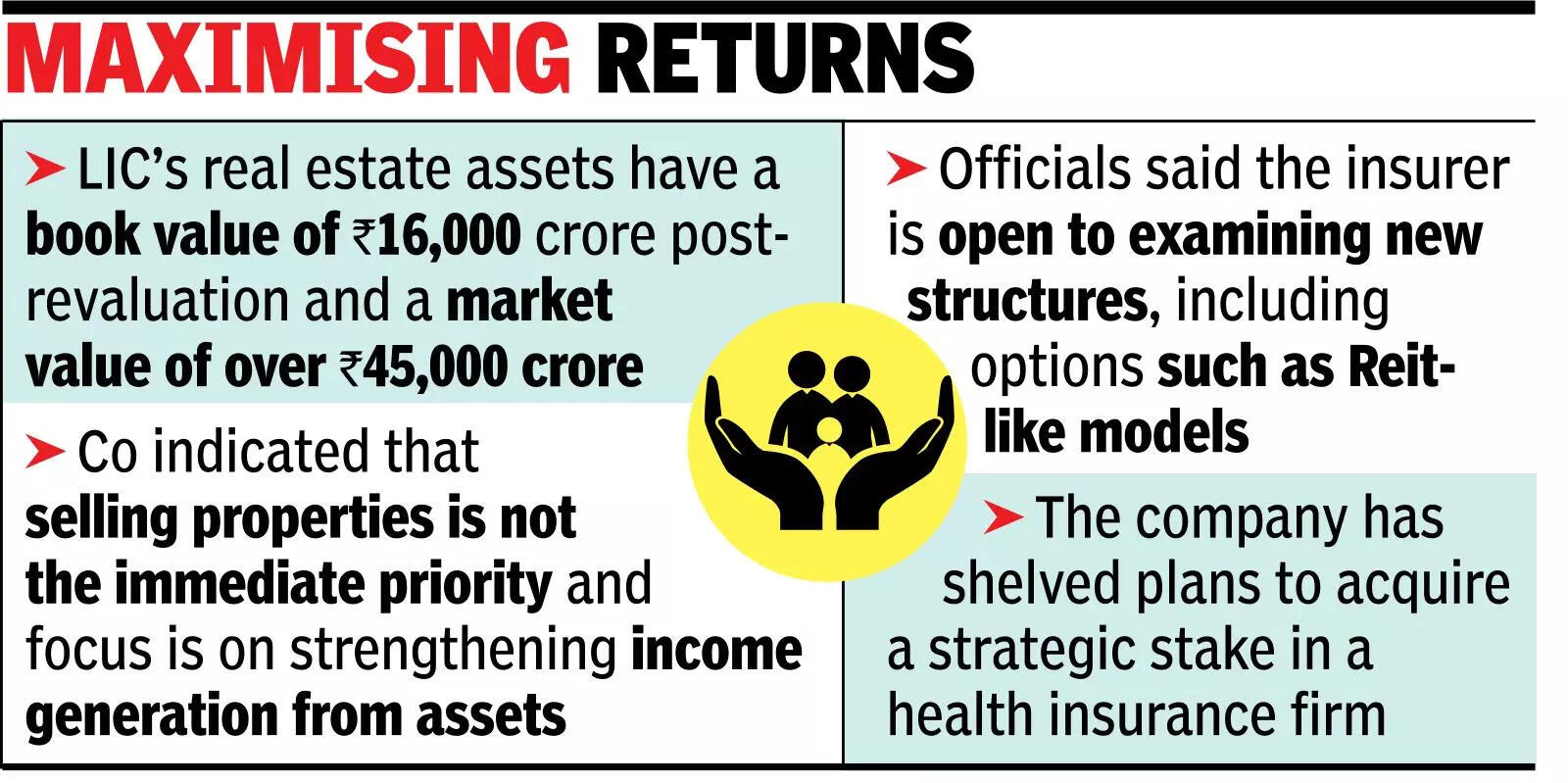

MUMBAI: Life Insurance Corporation will soon take measures to increase the yield on its real estate assets, which have a book value of Rs 16,000 crore post-revaluation and a market value of over Rs 45,000 crore. Officials said that while real estate typically yields 3-4%, the capital gains are much higher. The corporation has also shelved plans to acquire a strategic stake in a health insurance company.Addressing a press conference after the board meeting, the corporation’s MD & CEO R Doraiswamy said LIC has decided to go slow on its earlier announced plan of entering the health insurance business, which was announced by his predecessor. “There was a plan to enter as a strategic investor in a standalone health insurance company to understand the market. But while evaluating options, we find it is not immediately required. So we are not moving fast. As and when we find a suitable opportunity, we will look at it,” he said.

Maximising returns

Officials said LIC is reviewing its entire real estate portfolio to identify ways to enhance yields. It indicated that selling properties is not the immediate priority and the focus is on strengthening income generation from the assets. Officials said the insurer is also open to examining new structures, including options such as Reit-like models, although no decision has been taken yet.In her Budget speech, finance minister Nirmala Sitharaman said that the govt would accelerate recycling of significant real estate assets of central public sector enterprises through the setting up of dedicated Reits.For the quarter ended Dec 2025, the corporation reported standalone net profit of Rs 12,958 crore, up 17.2% from Rs 11,056 crore in the corresponding year-ago period.Profit before tax rose 16.7% to Rs 12,897 crore from Rs 11,056 crore, according to the insurer’s reviewed standalone financial results. Net premium income rose 17.5% to Rs 1,25,613 crore from Rs 1,06,891 crore, supported by growth in new business and single premium products.The corporation has not yet taken a call on selling stake in NSE, where it is a major shareholder, in the forthcoming IPO.